Insurance Elevated: The Power of Comprehensive Coverage

Insurance elevated is a comprehensive insurance coverage provider for individuals and businesses. With a range of policies tailored to meet different needs, they offer peace of mind and protection against unforeseen risks.

Their customer-centric approach ensures personalized service and prompt assistance in times of need. In today’s fast-paced world, safeguarding yourself and your assets is more crucial than ever. That’s where insurance elevated comes in. As a trusted insurance provider, they understand that each individual and business requires unique coverage.

With their wide range of policies, they offer a personalized approach, ensuring that you get the protection you need. Whether it’s for your home, car, health, or business, insurance elevated has got you covered. They go the extra mile to provide prompt assistance and support during emergencies, giving you peace of mind and security. Don’t leave your future to chance – let insurance elevated elevate your insurance experience.

Credit: www.riskandinsurance-digital.com

Understanding Comprehensive Insurance

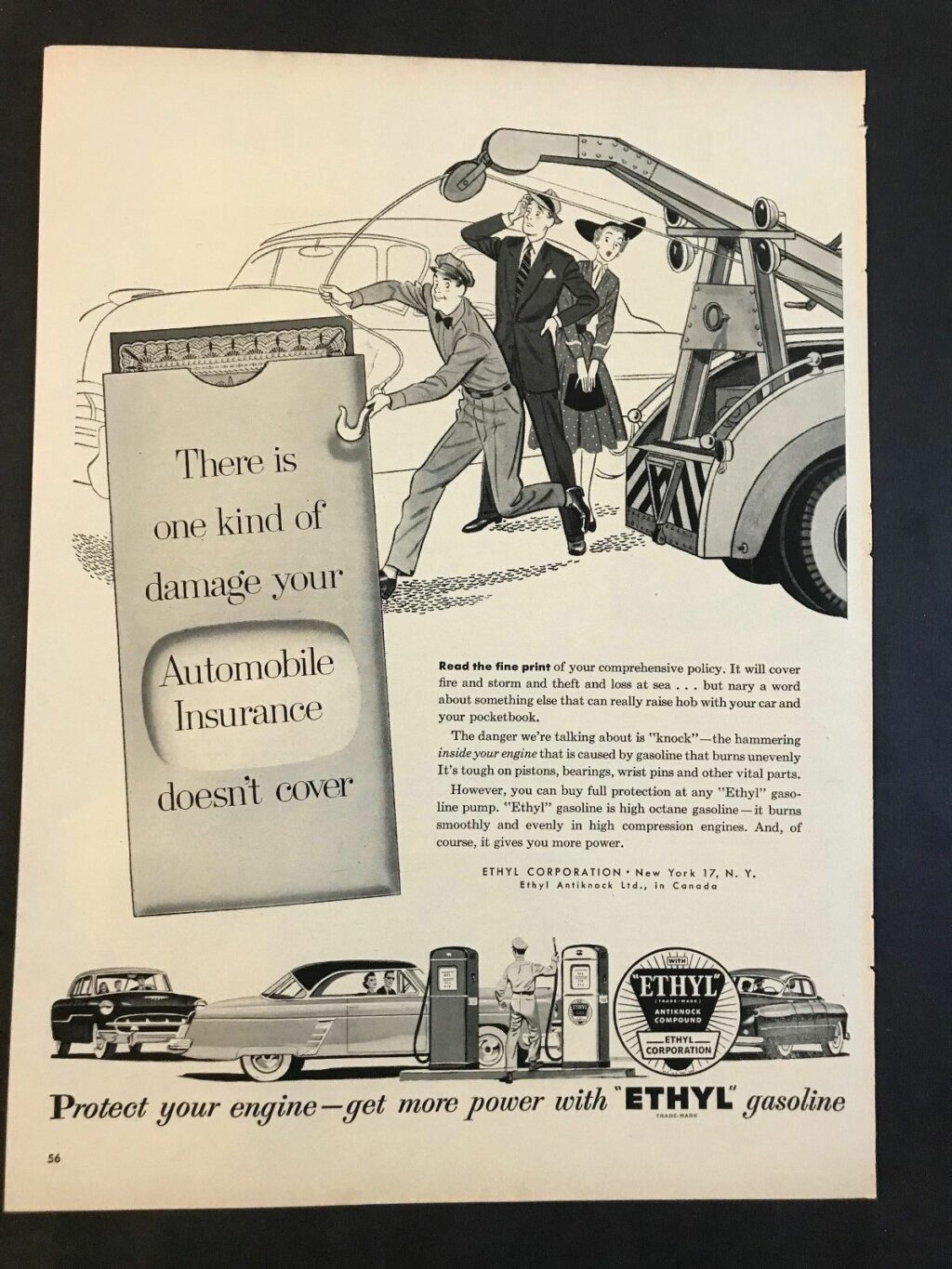

Comprehensive insurance entails a broad coverage plan that protects against various risks and damages. It provides financial assistance for damages caused by incidents other than accidents, such as theft, vandalism, natural disasters, or falling objects. Different from other types of insurance, like liability or collision coverage, comprehensive insurance fills in the gaps left uncovered by those policies.

It includes coverage for incidents that fall outside the scope of standard insurance plans. Comprehensive insurance offers peace of mind and financial security in unexpected situations, ensuring that individuals are protected against a wide array of potential risks. By understanding the concept of comprehensive insurance, individuals can choose the right coverage for their needs and safeguard their assets effectively.

It is crucial to review different insurance options and seek guidance from professionals to make informed decisions and secure comprehensive insurance coverage.

Benefits Of Comprehensive Insurance

Comprehensive insurance offers numerous benefits for car owners. It provides protection against theft and vandalism, covering any damages incurred. Additionally, it shields vehicles from the devastating effects of natural disasters such as floods, hurricanes, or earthquakes. Animal-related damages, including collisions with animals on the road, are also covered.

With comprehensive insurance, car owners can have peace of mind knowing that they are financially protected against various unforeseen events. Whether it’s a stolen car, a vehicle damaged by vandals, or repairs needed due to a natural disaster, comprehensive insurance ensures that the costs are taken care of.

This type of insurance not only secures the financial aspect but also offers a sense of security, allowing car owners to drive with confidence. So, consider elevating your insurance coverage with comprehensive insurance to protect your vehicle from potential risks.

Choosing The Right Comprehensive Coverage

Choosing the right comprehensive coverage involves evaluating your specific needs, understanding policy limits and deductibles, and comparing quotes from different insurance providers. When it comes to selecting insurance, it’s important to consider factors such as the value of your assets, your budget, and the level of risk you face.

By thoroughly considering these aspects, you can ensure that you have the appropriate coverage to protect your finances and assets in the event of unexpected accidents or damages. Comparing quotes from multiple insurance providers allows you to find the best option that meets both your needs and budget.

Remember to carefully read and understand the policy limits and deductibles to avoid any surprises or gaps in coverage.

Conclusion

Insurance elevated is the ultimate solution for securing your assets and protecting your financial well-being. With its comprehensive coverage options and innovative features, it takes your insurance experience to new heights. By offering personalized policies tailored to your specific needs, insurance elevated ensures that you have the right protection in place.

Its advanced technology and user-friendly interface make managing your insurance policies a breeze, saving you time and stress. With a wide range of insurance products available, from auto to home to life insurance, insurance elevated has you covered for all of life’s unexpected events.

So, whether you’re a young professional starting out or a growing family, insurance elevated is your trusted partner in safeguarding your future. Don’t settle for average when you can elevate your insurance experience with insurance elevated. Trust us to provide you with the peace of mind and financial security you deserve.

Hallmark Insurance Downgrade: Protect Your Investments Now!

Hallmark Insurance Downgrade: Protect Your Investments Now!  How to Prepare Your CPA Firm for a Successful Exit: A Step-by-Step Guide

How to Prepare Your CPA Firm for a Successful Exit: A Step-by-Step Guide  How Fixed and Variable Costs Impact Your Stock Trading

How Fixed and Variable Costs Impact Your Stock Trading  Leveraged and Inverse ETFs: Strategies for Volatile Markets

Leveraged and Inverse ETFs: Strategies for Volatile Markets