How Fixed and Variable Costs Impact Your Stock Trading

Understanding the costs involved in stock trading is essential for traders looking to maximise their profits and minimise unnecessary expenditures. Whether you’re a day trader, swing trader, or long-term investor, knowing how fixed and variable costs affect your trading strategy can make a significant difference in your bottom line. This article delves into the two types of costs—fixed and variable—and how they impact profitability and strategies for managing these expenses effectively.

Understanding Fixed and Variable Costs in Trading

Fixed costs refer to expenses that do not change regardless of how much or how little you trade. These costs remain constant and are usually incurred regularly, whether you’re actively trading or not. For example, many traders pay monthly or annual fees for trading platforms, data feeds, or brokerage account maintenance. These are fixed costs because they are predictable and unaffected by your trading volume.

On the other hand, variable costs fluctuate depending on your trading activity. The more you trade, the higher these costs can become. Transaction fees, commissions per trade, slippage (the difference between the expected price of a trade and the actual price), and margin interest all fall under variable costs. These costs are tied to each trade you execute and can increase significantly if you engage in high-frequency trading or leverage positions. Unlike fixed costs, variable costs can change daily, and as such, they require careful attention to prevent them from eating into your profits.

The key difference between fixed and variable costs lies in their predictability and the way they scale with your trading behaviour. Fixed costs are steady and stable, while variable costs can rise as you increase your trading activity. Click here now for more info.

Examples of Fixed Costs in Stock Trading

Many traders use specialised platforms for executing trades, conducting research, and analysing market data. These platforms often charge a subscription fee, which is a fixed cost. Whether you’re trading a single stock or thousands, the platform fee remains the same. This is true for both paid trading platforms and data services that provide real-time quotes and technical analysis tools. The subscription fee is generally paid monthly or annually, and while it is fixed, traders must evaluate whether the platform’s features justify the cost.

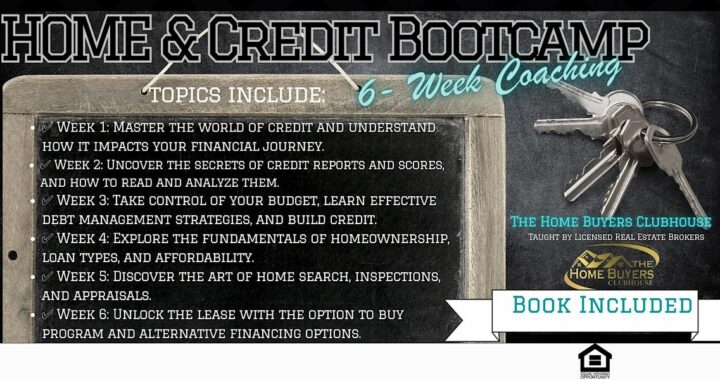

Many traders invest in educational resources to improve their skills. These may include books, online courses, webinars, and certifications. While these costs are one-time or annual expenses, they are still considered fixed because they don’t vary based on your trading frequency. Education plays a significant role in shaping trading strategies, but it’s important to evaluate whether the return on investment from these resources justifies their fixed costs.

Examples of Variable Costs in Stock Trading

Commissions are one of the most direct and well-known variable costs in stock trading. These are the fees charged by brokers for executing trades. While some brokers offer commission-free trades, others may charge a fixed amount per trade or a percentage of the total trade value. Additionally, there is often a bid-ask spread, which is the difference between the buying and selling price of a stock. The wider the spread, the more you’ll pay in costs. These expenses vary depending on the frequency and volume of trades, as well as the type of broker you choose. Frequent traders, such as day traders, will find these costs adding up quickly, significantly impacting their profitability.

In addition to broker commissions, traders also face transaction fees, which can include exchange fees or regulatory costs imposed by government agencies or financial institutions. These fees can be small individually but can accumulate over time, especially for high-volume traders. Although these costs are generally minor, they are still part of the variable cost structure and need to be taken into account when assessing your trading expenses.

How Fixed and Variable Costs Affect Profitability

To make a profit in stock trading, you need to cover both fixed and variable costs. The break-even point is where your total profits equal your total costs, meaning you’re neither gaining nor losing money. For a day trader, for instance, fixed costs such as the platform subscription and educational resources remain constant, while the variable costs will depend on the number of trades executed. For a trader to break even, they must account for all fixed costs and ensure that the profit from each trade exceeds the commission and transaction fees.

Traders who focus on high-frequency or short-term strategies, like day trading, will be significantly affected by variable costs. With more trades comes a higher cumulative cost, meaning these traders need to ensure that their profits from each trade are large enough to overcome the fees they’re paying. On the other hand, long-term investors or those employing swing trading strategies are less impacted by variable costs because they typically make fewer trades and may incur lower transaction fees. For long-term traders, minimising fixed costs, such as selecting a low-cost trading platform, becomes more important than reducing variable costs.

Conclusion

Understanding the distinction between fixed and variable costs is essential for traders who want to optimise their trading strategies and enhance profitability. By evaluating both types of costs and employing strategies to manage them, traders can minimise financial obstacles and maximise returns. Balancing fixed costs and reducing variable costs through thoughtful planning and resource management will ultimately contribute to long-term success in stock trading.

How to Prepare Your CPA Firm for a Successful Exit: A Step-by-Step Guide

How to Prepare Your CPA Firm for a Successful Exit: A Step-by-Step Guide  Finance Lease : Master Your Financial Future

Finance Lease : Master Your Financial Future  Finance Loan : Unlock Your Financial Freedom Today

Finance Loan : Unlock Your Financial Freedom Today  How Fixed and Variable Costs Impact Your Stock Trading

How Fixed and Variable Costs Impact Your Stock Trading  Leveraged and Inverse ETFs: Strategies for Volatile Markets

Leveraged and Inverse ETFs: Strategies for Volatile Markets  Hallmark Insurance Downgrade: Protect Your Investments Now!

Hallmark Insurance Downgrade: Protect Your Investments Now!